This blog post is a summary of a longer piece first published in SBC Issue 156 from September, shared openly because confusion around the black market affects every bettor and practical guidance on staying safe should not sit behind a paywall.

This article explains why the topic of black market betting is everywhere, what the arguments miss, and the simple steps you can take to keep your money safe. PLUS how to find and source more regulated options to bet with.

For even more on this – listen to me chat about it with Tom Brownlee on his recent live podcast where we explore it in greater detail.

Read more on SBC 156 and the content you can enjoy each month as a Smart Betting Club member.

Black Market Growth & What It Means For Winners

The black market is in the news again due its growth, and different groups are rushing to claim what is happening and why.

Betting is also a political football right now, which is dangerous when politicians and campaigners chase headlines with cheap lines rather than actions that truly help.

Our view is simple, when the legal path is filled with checks and friction, some bettors look for easier routes and that is behind why so many are using black market books.

That shift carries real payment risk for winners – such as many with a Smart Betting Club membership, which is why we published this piece. In short, our advice is to use licensed and trusted operators, to check a licence before you deposit, and to build a wider set of regulated options so you are not tied to one firm.

One issue currently thought is the simple act of finding out if a firm is licensed is not straightforward for many people.

Much clearer signposting, a simple checker – be it a website/app and a public education campaign are needed so anyone can verify a licence in seconds.

Why This Matters Now

You will have seen headlines saying the black market is growing and the debate over it which rages on, especially on X/Twitter.

Some voices call for more tax and more rules, yet many bettors tell us that tighter rules and higher friction have pushed people from regulated sites.

The pattern is familiar, make the legal route harder, and some users try the other path. That does not make it wise, it does explain why this topic keeps returning.

One high profile report published by Yield Sec which made headlines, put illegal operators at roughly 9 percent of Britain’s online market. This shows how a single figure can shape the debate, even though the same report raises more questions than it answers.

Ignoring Affordability Checks – Why?

Once you read beyond the headline, the Yield Sec report leaves key questions unanswered.

Measuring an illegal market is hard by nature, sites appear and disappear, domains are mirrored, users mask location, and a lot of it takes place on instant messenger apps – some of which are encrypted. Payment is taken in the form of cash, crypto or digital wallets. All tough things to accurately gauge the usage of.

We are also cautious because the report suggests that growth is driven by two groups only: self excluded customers and under eighteen year olds.

That ignores everyday routes into unlicensed sites that many mainstream bettors take, including most importantly – the friction from affordability checks and onerous deposit limits.

Licensed books are made to ask for all kinds of intrusive and personal financial documents (and apply limits to what you can bet) whilst black market sites don’t.

Is it any wonder people choose the latter, even if unwittingly so?

By leaving this key driver out from the reasons behind the growth of the black market – you miss the lived reality that pushes people off the regulated path.

Ignoring this point undermined any confidence from us in the conclusions of the Yield Sec report.

The commissioning link to the Campaign for Fairer Gambling also matters (and those behind it and their motivations) so readers should treat the claims with care while independent evidence builds over time.

How to check a UK licence quickly

Putting aside the debate for why the black market has grown of late – we also need to get into how hard it is to find out if a bookmaker is regulated.

Many black market bookmakers present polished websites, and it is easy for a casual customer to assume everything is in order. In practice, it can be hard to tell who is licensed at a glance.

Currently to ascertain this fact, you have to scroll to the footer of the bookmaker website, look for a licence number and a link to the Gambling Commission register.

- Then you need to open the Public Register, search for the business name and the domain, then confirm that the entry covers remote betting.

- If you cannot match brand, operator, and domain to the register, then chances are it might be a black market bookmaker.

It might be relatively easy for an experienced bettor to do this – but what chance does someone that doesn’t bet regularly or understand the betting industry have?

Even if they do know that it’s the Gambling Commission who license bookmakers, how then will they know to visit the register and navigate terms such as ‘remote license’ and ‘white label’ to understand what that all means.

In my chat with Tom Brownlee on his live show recently, I gave an example of exploring whether the bookmaker, Bzeebet was licensed in the UK.

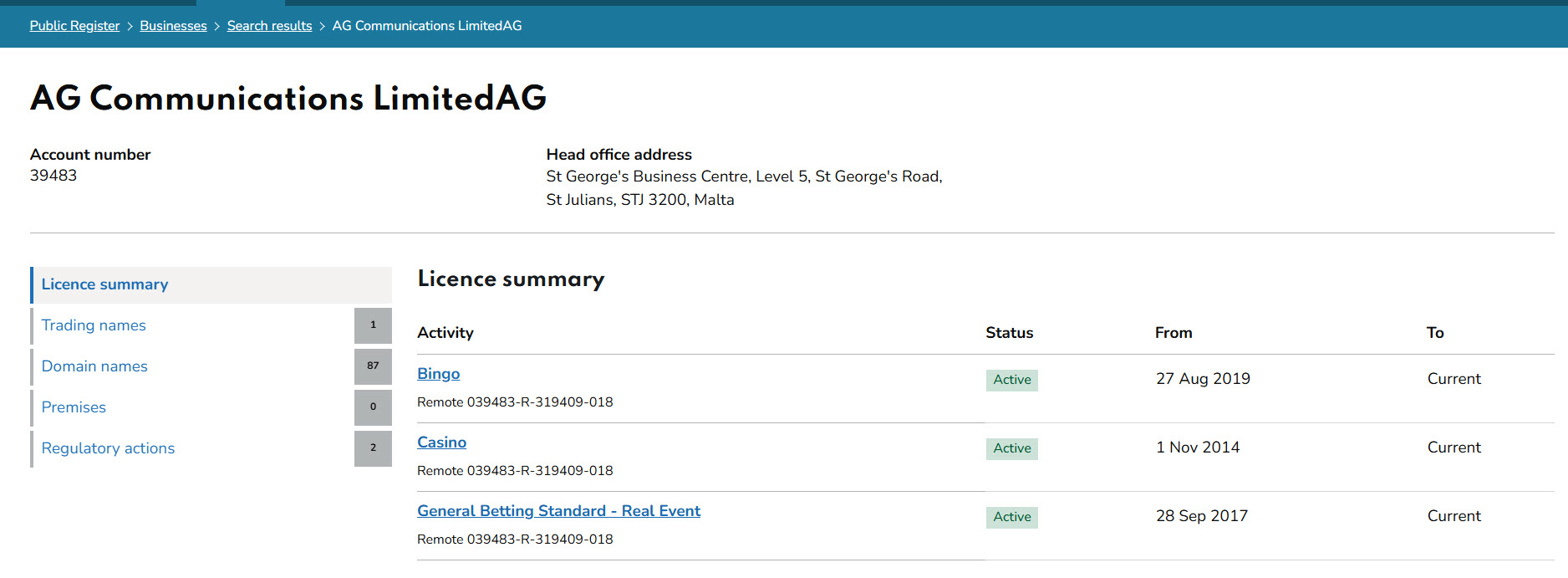

A search on the Gambling Commission register for Bzeebet, returned the name of their parent company – AG Communications Limited.

This then lists a Malta address as their head office alongside a list of 87 Domain names.

You have to then scroll through that list of Domain names to find www.bzeebet.com before realising its verified.

This should be simpler for the public.

We support a clear badge that can be verified, and a basic awareness campaign that shows people both how to confirm a licence in plain steps and why betting in the black market is dangerous.

It simply beggars belief that something so simple has not been put into practice as of yet.

Is it any wonder therefore that a black market grows when its users are not made aware of its downsides in plain language? Or why there is no central, easy-to-reference resource that tells them who is legal and who is not?

It’s not good enough to simply trust a logo or a link on a bookmakers website as they are easily and widely copied by black market bookmakers.

There really needs to be an easy to find, central source to display results in plain language and a campaign to inform and educate the public about the dangers of black market betting.

Safer habits for winning bettors

Ultimately the reality for winning bettors is that using the black market is a huge risk.

I understand the temptation of using them – no KYC, affordability checks, deposit limits and often tempting bonuses and welcome offers. Yet it’s important to state that as winning bettors, our chances of getting paid out by an unlicensed firm are lower than an everyday losing bettor.

They might get paid out as the bookmaker believes anything they withdraw will get deposited back with interest in the future (i.e. they will lose more). Yet the bookmaker will be able to quickly identify winning bettors and know that any withdrawals will only be followed by more in the future.

They absolutely do not want to pay you – and many won’t.

In some cases, black market bookmakers are also actively keen not to pay out so word spreads around ‘winners’ not to use them.

The biggest online firms also invest heavily in scoping out multi accounters and abusage of their T&C’s as part of this. They know they are vulnerable and the money they don’t pay on tax, compliance, media rights and the rest is invested into areas like this.

Safest Approach – Explore The Regulated Options

The safest habit for winners is to ignore the black market entirely and look beyond the biggest brands and explore other regulated options.

After all there were 175 regulated, online firms in the UK alone to tackle (OK, many are white labels – but they still offer a plethora of options)

A wider roster gives you better access to markets, more stable account health, and less reliance on any single firm.

Many of these firms also reference the same odds as bigger bookmakers yet without the same oversight or teams or traders to spot shrewd bettors.

That’s not to say they are going to just let you get on what you want, when you want. You will still have to abide by deposit limits, supply documents and of course deal with restrictions and closures if you win too much. Some will be harsher than others on this front. Some will be easier than others on this front. But most are worth trying out.

This gives you options to bet and with some firms it can be worth the effort – especially for an account profiled as ‘square’ or one that starts with a losing run.

Because after all, life does not start and end with bookies that are listed on Oddschecker. There are many more, smaller operators you can legally bet with from the UK alone.

But… Be Sensible

Before you scale up and ramp up with several of these smaller bookies – our advice is to run small test deposits and withdrawals to confirm that payments work smoothly. Get the account verified and build your confidence and experience in what they offer.

Keep a simple record of balances, limits, terms, and key conversations, and use screenshots and email for anything important.

Withdraw on a schedule, rather than letting balances build without reason. Treat any operator that drags its feet on verification or payments as a warning sign and move on quickly to alternatives that pass the register checks.

Use Trustpilot, AI and internet reviews to gauge whether to use a firm or not – most are fine, yet a few have bad reputations, even as legalised firms.

Yes, we fully recognise that many regulated firms treat customers badly and sometimes don’t play fair or pay out. Those of us in betting long enough have all witnessed this first hand.

Yet the reality is that even in a dispute you are so much more likely to get paid out with a regulated firm than with a black market operator. Some of the latter might pay you out, but most will not and that is especially true if you win particularly large sums or are pinned as a shrewd bettor.

Here at SBC we have also published a guide to navigating bookmaker disputes with regulated firms. It sets out the steps to take, the evidence to keep, and the routes available if a complaint is needed.

We are also working on a bookmaker database for members to help inform on this front further.

In Summary

In the end, the rise of black market betting is not about greed or recklessness. It is a direct response to a system that makes it harder for regular punters to stay on the right side of regulation.

When rules, checks, and friction grow, some people look for shortcuts, often unaware of the risks that follow. Those risks are real, from payment delays to outright loss of funds, and they hit winning bettors hardest.

The solution is not to turn a blind eye, but to make safer choices easier. That means clearer tools to verify bookmaker licences, better education on what regulated betting looks like, and more choice within the legal market.

As bettors, we can take practical steps now: use the Gambling Commission register, test withdrawals early, keep good records, and avoid unlicensed sites entirely.

Staying safe is not just about protecting your balance, it is about protecting your ability to keep winning in the long run.

And that after all is what matters most to those of us who enjoy betting. Winning in the long run.