July 2021 Update: How safe is the money you deposit with bookmakers? Essential advice and information

I have a very important update to share with you on the topic of bookmaker fund security – or indeed the lack of it from many of the firms that we all bet with and what you need to know about it.

This is a topic I have regularly discussed over the years and what follows is an update to the original article first published in 2019 on this subject to ensure that none of you suffer the issue of holding large funds in bookmaker accounts that you are unable to access.

Whilst not the ‘sexiest’ of topics – it certainly is an essential one for anyone that bets, so please do take the time to read it and understand more on how safe the funds you deposit with bookmakers actually are…

Why So Many Bookmakers Fail To Protect The Funds You Deposit

I imagine when most people open a bookmaker account and deposit money into it, the question of ‘how secure is this money?’ doesn’t likely cross their mind.

Instead it is likely filled of ideas of what to bet on or the free bets and offers to take advantage of.

Perhaps though if we were to ask them this question of ‘fund security’, most might reasonably assume that this money deposited is in some way ringfenced or protected, so that if the bookmaker went bust, these funds would be returned without issue.

After all, if a bookmaker can’t afford to pay out a balance when requested, should they even hold a licence to take bets?

Well that reasonable assumption of complete fund security is sadly very wrong as there is no current obligation for a UK licensed bookmaker to ringfence customers funds and ensure that if as a firm they became insolvent, all customer balances would be returned in full.

This is the current stance as overseen by the The Gambling Commission who oversee licensing requirements for bookmakers in the UK. They explain as much on their website, where they state that

“Money staked or deposited with a gambling business is not protected by the government the way that personal bank accounts are.

Any company you make a bet with must tell you whether your money is protected in case they were to go bust. This information should help you decide who to gamble with and how much money to leave in your account.”

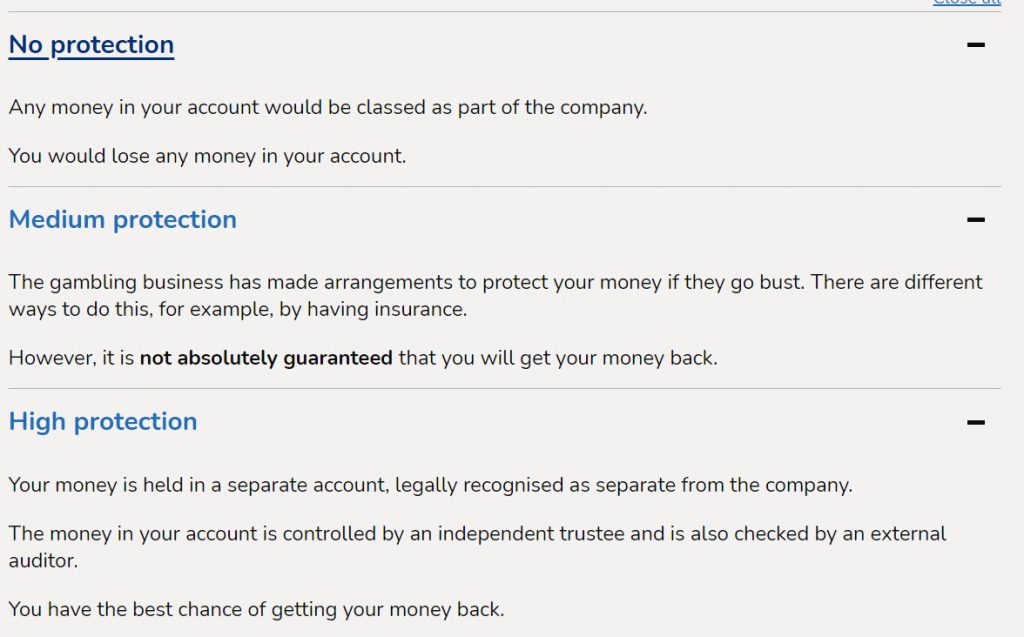

So, rather than make it a prerequisite for licensing to ensure funds are protected, instead they simply rate each bookmaker and the level of protection or not, given as per the description below:

The level itself is self-declared by each bookmaker but the Gambling Commission is able to check the accuracy – although no outline is given how often this is done.

Ultimately, they leave it up to you – the individual bettor to check on how safe your money is or not.

And the sad reality is for the majority of bookmakers it is not safe.

How To Check Each Bookmaker’s Protection of Funds Rating

Although the onus is on us as punters to check on this issue – help is at hand thanks to the excellent Register of Protection of Funds as put together by the Horseracing Bettors Forum (HBF).

The HBF have done the hard work and trawled through each set of terms and conditions to discover how safe your funds are with all the main bookmakers currently operating. It is exceptional work and the HBF need to be congratulated for it.

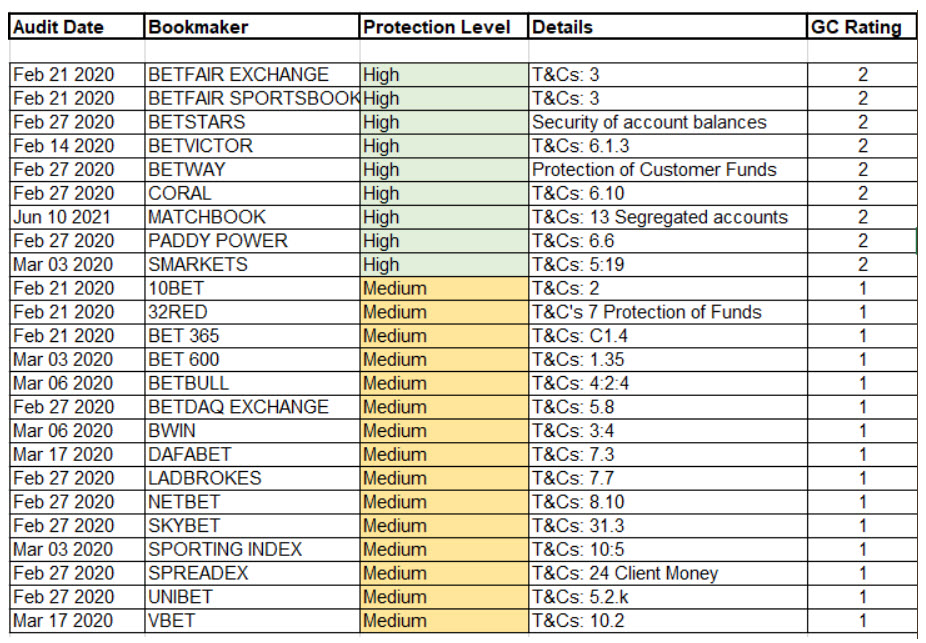

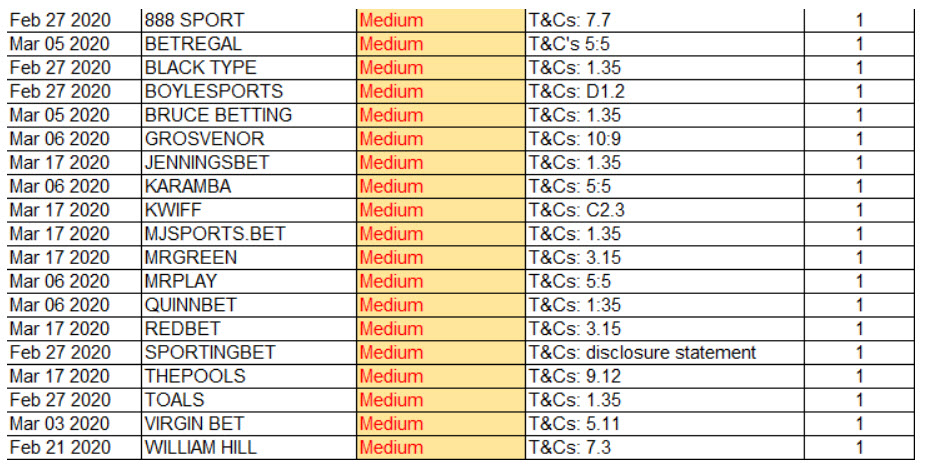

This was last updated back in early 2020 although does include the high ratings recently obtained by both Betway and Matchbook in 2021.

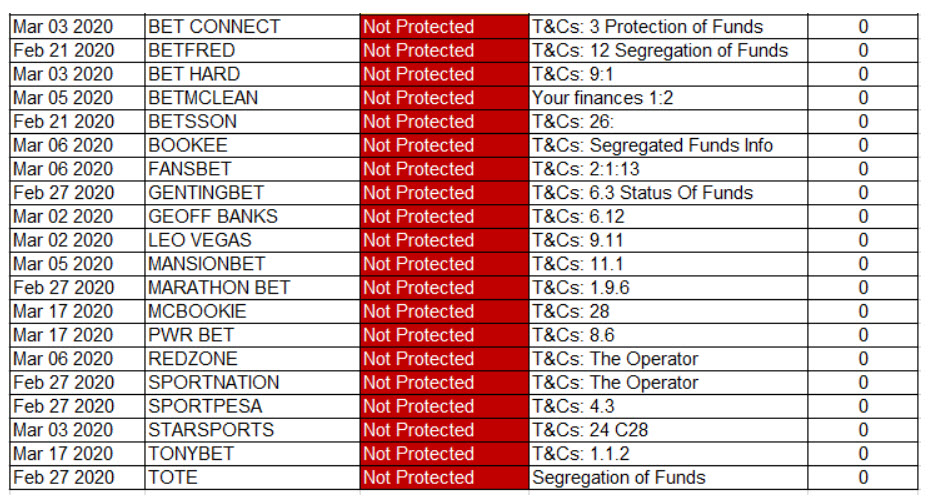

Of particular concern are those 20 firms offering No Protection whatsoever. This includes big name firms such as Betfred, Marathon Bet and Star Sports.

Questions need to be put to all these firms to ask why they don’t protect funds and offer no protection.

After all, Marathon Bet can afford to sponsor the likes of Man City, whilst Betfred sponsor everything from the World Snooker Championships through to the British Masters, yet they can’t find the wherewithal to protect customers funds!

15 of the firms audited fall into the Medium Protection bracket which outlines that money is separate (or that there are arrangements in case of insolvency such as insurance) yet there are a further 19 bookmakers that are deemed a ‘Lower Medium’ ranking by HBF where they state they cannot ‘guarantee’ that all funds will be repaid.

Just 9 firms take this seriously enough to offer High Protection and well done to Betfair Exchange & Sportsbook, Betstars, Bet Victor, Betway, Coral, Matchbook, Paddy Power and Smarkets for taking the lead here.

Ultimately, it has to be of concern that of the 63 firms audited by the HBF, only 14.28% of them offer this high rating, whilst 31.74% offer no protection at all.

You can view a breakdown of each firm in the table below:

How Likely Is A Bookmaker To Go Bust?

The next question you might well be asking – is how likely is it for a bookmaker to go to the wall?

Well, we have seen a few such examples of this in recent years, with firms such as MoPlay, Sunbets, Stan James and BetBright all no longer in existence.

When MoPlay went bust in early 2020, we had the nightmare scenario unfold whereby they were unable to settle open bets and unable to pay out the funds owed to customers.

Thankfully for UK and Irish customers at least, there was value in some of the assets that MoPlay had – specifically their customer database and Betfred took over this and transferred all balances from MoPlay over to them. All 180,000 of them – EXCEPT for those customers previously closed down by Betfred as The Guardian’s Greg Wood reported.

Tellingly, Betfred did not explicitly deny they had not transferred profitable accounts (note the usage of the term ‘eligible customer accounts’) and this story didn’t go any further. Many punters impacted were at the mercy of getting their balance from the liquidator of MoPlay – which likely would result in at best receiving a very small proportion of their funds back.

Effectively, many winning punters got screwed over here.

Its also worth pointing out that this only covers UK and Irish MoPlay customers and those with accounts from other countries had to hope for similar deals to be struck as to the Betfred one for where they live.

In recent months we have also had the debacle with Football Index as well – not something I know a huge amount about, yet from what I have read, again it goes to the heart of the licensing of this firm and the lack of protection provided to customers funds.

Antepost Caution & Regular Withdrawals

Armed with the information above, you would therefore be very wise to proceed with caution leaving sizeable sums of money in any account with a bookmaker only offering less than a High level of protection.

If such a bookmaker went bust, in theory you wouldn’t likely see much, if any of that money again with a bookmaker offering No protection.

Those offering Medium Protection might well cover you (depending confusingly what level of ‘Medium’ protection they offer), yet there are all kinds of terms and conditions at play here.

Its notable that even with a High level of protection, the Gambling Commission still hedge their bets and say that “You have the highest level of protection and the best chance of getting your money back.”

“Having the best chance of getting your money back” isn’t a phrase that inspires confidence. If I read that on a bank’s website, I would never put my money in!

The likelihood is that for those bigger name bookmakers, they wont easily go to the wall, but for the smaller outfits such as we saw with MoPlay, it might be more of a concern. After all the bookmaking world is extremely competitive and hard to profit from if not established as a ‘big name’.

Don’t be fooled either by the fact that some firms appear on websites like Oddschecker as some kind of guarantee they are well run. MoPlay were featured on the Oddschecker matrix (presumably because they paid enough) and look what happened there!

It might be that we also see further examples as per Betbright, whereby upon their closure, unsettled Ante-post bets held were not initially settled or paid up until a major PR storm compelled them into eventually doing so.

Therefore – one simple bit of advice is to be very careful where you place your Ante-post bets – and focus on placing them with more established names or those with at least a Medium or High rating.

Keep Your Balances Low & Money In YOUR Bank Account

It is also sensible advice to keep your balances with those firms with no protection to a relative minimum, because quite simply your money is not safe.

Maintain a balance required for you to place your regular wagers only and deposit and withdraw regularly if needed.

You simply don’t want the headache as caused by the closure of a bookmaker like MoPlay and the refusal by Betfred to transfer over certain accounts they didn’t want.

All told it was an incredibly frustrating situation for those impacted by MoPlay and I want to make sure no-one else suffers the same issue in the future should other bookmakers declare insolvency.

This is likely given the increasingly cutthroat and competitive bookmaking world where margins are tighter and increasing focus on topics like problem gambling are eating into many firms profits. I expect more to go to the wall in the future.

Without a doubt, ensuring that ALL firms offer full protection of funds deposited should 100% be a requirement of obtaining and maintaining a bookmakers license. I hope that the various government reviews into gambling look into this as a matter of urgency.

Until they do, my sincere advice is to never leave large amounts sitting dormant in any account as it’s far better to have such money securely tucked away in your bank account earning you interest.

Don’t risk it – withdraw all but the funds you need for your regular betting activity from bookmaker accounts, especially those with no protection.

Non-UK Punters: Although this article concerns the UK Gambling Commission, each country has its own rules and regulations as per licensing and I urge those of you outside the UK to explore this based on where you live. If in doubt – follow the same advice as above and withdraw regularly, never leaving large sums of money in your account!

Do Bookies Monitor Withdrawals?

One of the other questions that this all throws up is whether or not bookmakers monitor withdrawals and red flag punters who regularly take out winnings from their accounts.

As we all know by now – bookmakers go to extraordinary lengths to profile punters for account restrictions and withdrawal frequency and the amounts taken out is something they could monitor.

I put this question to our bookmaker insider ‘The Poacher’ and his thoughts are that it’s wise to leave your account funded at all times, even if just a small amount..

“Generally speaking, if withdrawing winnings you should always leave some money in your betting account – at least a fighting fund that you can afford to lose if the worst happens. Punters who withdraw their entire balance can be viewed as ‘savvy’ as bookmakers know that customers who leave money in their account, usually end up losing it.

He then went onto share his own ‘withdrawal strategy’:

“What I do is to withdraw slightly more than I plan to, then a few minutes later, place a few more bets and deposit again. This makes you look like you can’t hang onto your winnings – which is of course exactly the type of punter a bookmaker wants”

I have had this opinion backed up by several others that I trust within the industry and regular withdrawals and deposits are sensible alongside the fact you should never leave large sums in an account.

As ever, it’s not an exact science, so simply do your best and use logic and sense when it comes to withdrawals and their frequency.

As and when further news or developments on bookmakers and their ‘protection’ ratings come to light, I will of course share this with you. Until then be careful with whom and how much you deposit.

This article was updated on the 15th July 2021 – all information correct as of that date.